If you’re trying to get someplace, it helps to know where you are. In the case of diabetes management with intensive insulin therapy, this means tracking blood glucose (BG) levels, which are constantly in flux due to a range of factors such as diet, exercise, stress, insulin dynamics, health status, etc. Maintaining BG levels within a desirable range can be challenging. Traditionally, patients maintain glycemic control by manually taking BG measurements 3-6 times a day with a finger-stick test and managing carb consumption and insulin administration based on these measurements. In my view, this approach is somewhat analogous to navigating a winding road with many intersections using a GPS SatNav system that only reads out once every few hours! Common issues with traditional therapy include over-correction (potentially leading to dangerous episodes of hypoglycaemia) and under-correction (result: hyperglycaemia). Nocturnal hypos are an area of particular concern, with estimates suggesting prevalence as high as 68%.

Continuous Glucose Monitoring (CGM) was developed to improve this situation by allowing diabetics to automatically measure their glucose levels on a continuous basis. Today, this is done using disposable body-worn sensors that sample glucose levels in subcutaneous interstitial fluids, which are known to be strongly correlated with blood glucose, with a slight lag (around 10 minutes).

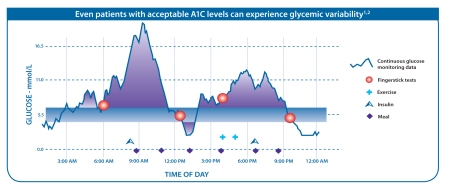

As illustrated in the diagram below, CGM can provide a more complete picture of glucose level variability, revealing important peaks and troughs that would otherwise not be evident using only traditional intermittent BG testing.

Moreover, CGM can detect emerging trends in real time, allowing for intervention before unsafe BG levels are reached, and can reveal correlations with other factors such as diet and exercise. CGM also offers greater convenience and discretion for patients and reduces the number for finger-stick blood samples required (usually twice a day for calibration). All these reasons make CGM a highly promising device innovation, accounting for why this is the fastest-growing diabetes product segment (currently 20% per year).CGM Players

The current market leader in CGM is US-based Dexcom, which is listed on NASDAQ with a market cap of around $2 billion at present. Dexcom’s latest sensor (the G4 PLATINUM launched in 2012) is widely seen as the best device commercially available, offering the greatest accuracy and comfort. In 2012, Dexcom had sales of almost $100 million—enjoying an astonishing 41% growth in the year—while still generating an annual operating loss of nearly $56 million. This hyper-growth, combined with the “land grab” potential of the large market being addressed, is probably the reason Dexcom enjoys such a substantial market cap and a generous valuation of 20x sales, despite being loss-making since its IPO in 2005.

Unlike its rival Medtronic—which has its own CGM technology—Dexcom is exclusively focussed on sensing and does not have a proprietary insulin pump. Instead, Dexcom’s business model is to directly sell sensor systems only and to license access to its sensors to third party pump producers for integration with their insulin pump systems. Dexcom has such licensing arrangements with J&J/Animas and Tandem and, in the past, had a collaboration with patch pump leader Insulet, which it later abandoned under circumstances that are understood to be less than amicable.

As competition in the CGM market heats up, Dexcom’s current dominance may soon be rivalled. Medtronic is increasingly strengthening the value proposition of its integrated system by using its CGM to automatically control insulin delivery. Meanwhile, Roche is understood to be developing a new CGM sensor that is said, by clinicians familiar with the technology, to be the best sensing system yet. Lastly, Insulet is known to be developing a combined insulin patch-sensor device that combines in one patch both insulin delivery and glucose measurement. This could be attractive to patients who don’t wish to simultaneously wear two devices on their body.

At present, all CGM sensors currently available are disposable body-worn patches that are replaced every 3-7 days (with the latest generation of sensors generally operating at the longer end) and which sample interstitial fluids through a small in-dwelling transcutaneous electrochemical glucose oxidase sensor. Several groups are working on technologies that might change this paradigm. For example, Senseonics is developing an implantable, miniature CGM sensor that would be functional in vivo for 6-12 months. Promising validation results have already been reported and the company anticipates a European launch by the end of 2014.

Non-invasive glucose sensing is the holy grail of this field, but a notoriously challenging nut to crack. One fascinating approach is being pursued by Prof John Pickup at King’s College in London, where his team is working on a non-invasive glucose sensing technology based on a reversible glucose-binding protein attached to a flourophore that can be optically measured across the skin. A potential embodiment of this system would be a “smart tattoo” that would be read by an external sensor communicating with a smartphone.

An interesting wild card in this area could be the consumer electronics giant Apple, which some industry observers believe might be developing glucose sensing for its rumoured iWatch product. This speculation has been fuelled by Apple’s recruitment of staff from the recently shuttered C8 Medisensors, which was developing non-invasive optical glucose sensing technology.

Time will tell whether non-invasive glucose sensing ever makes its way into prime time use. But for the first time this appears to be moving out of science fiction into reality, as Abbott unveiled at the recent EASD congress in Barcelona its Flash Glucose Technology system based on a non-invasive body worn sensor that is worn for 14 days. Abbott expects this will be approved and launched in Europe in 2014. This will definitely be a product to watch as more information comes to light.

CGM benefits and Adoption

The clinical benefit of using CGM has been shown in a range of studies demonstrating the improved glycaemic control achievable through by CGM (eg, JDRF/NEJM 2008) and, in particular, the benefits of its use in combination with pump therapy (STAR/NEJM 2010).

Despite mounting evidence of benefit, widespread adoption of CGM still limited. In the US, Medicare does not have a national coverage policy for CGM; but reimbursement is provided under local coverage determinations and many private insurers cover CGM. In the UK, reimbursement is not in place and CGM is used on a case-by-case basis and often only for a limited period of time during corrective observational windows (however, NICE is expected to review this soon). One barrier to adoption may be that in order to secure the benefits of CGM, patients need to be highly skilled in self-management in order to make use of real time CGM data, which provides much more information on glycemic levels than traditional measurements. Furthermore, excessive “nuisance alarms”, especially while sleeping, have been seen by some people as undermining the user experience.

Enter: the Artificial Pancreas

A solution to these problems would be a system-based solution that provides greater automation and decision support. Groups like the JDRF are vigorously promoting this vision of a fully automated, closed-loop “artificial pancreas” system that senses glucose levels and automatically delivers and doses insulin (and possibly other hormones) using smart algorithms.

While a true artificial pancreas is still a ways off (with some experts questioning whether this will ever be practicable), in the near term we can expect to see greater use of semi-closed loop functionality, especially for safety purposes. Indeed, just this past week Medtronic announced that the FDA has approved for the first time a system to deliver the initial rudiments of an artificial pancreas, with the “Threshold Suspend” feature in its new MiniMed 530G with Enlite (a similar system, Paradigm VEO, has been available in Europe since 2012). This is the first device ever approved under the new FDA product classification, “OZO: Artificial Pancreas Device System, Threshold Suspend”. Meanwhile, Medtronic is also doing the heavy lifting of creating a new reimbursement code with CMS for an artificial pancreas.

The Medtronic system integrates an insulin pump with a CGM sensor, shutting off insulin delivery when glucose levels are too low in order to prevent hypoglycaemia when the patient is unable to self-monitor (eg, while sleeping). The benefits of this feature—mainly reduced rates of nocturnal hypos—were initially reported in smaller studies conducted in Europe by investigators such as Pratik Choudray (Diabetes Care 2011). More recently, Medtronic completed a larger randomized control trial called ASPIRE in order to support its FDA submission. The ASPIRE study looked at 247 patients with T1D, half of whom were provided a MiniMed integrated system (CGM with insulin infusion) with Threshold Suspend used to monitor glucose levels and to end insulin infusion when dangerously low levels are reached. The study, as reported this summer in the New England Journal of Medicine, found that the combination device reduced night-time hypoglycemia by nearly 32% and lowered the degree and duration of hypoglycemic events by 37.5%, all without serious adverse events.

Threshold Suspend is really just the first, small step towards a true artificial pancreas. Next-generation products are expected to use smarter “predictive” algorithms that will suspend and modulate insulin delivery based on trending BG values before critical thresholds are reached, with increasingly reduced interaction from patients required. Predictive algorithms have the potential to help transform diabetes management from a “rear view mirror” perspective to something that’s more forward looking. The goal of increasingly replicating the function of the pancreas may ultimately include delivery of glucagon as a positive control loop against hypo and will likely take into account a wider range of physiological parameters (eg, Dr. Wolpert at the Joslin has recently shown that dietary fat affects glucose concentrations and insulin requirements). Indeed, research organisations such as the Joslin are actively working on developing validated algorithms for decision making and controlling close-loop systems that may become the gold-standard in third-party systems (ie, “Joslin Inside”).

Achieving the vision of a true artificial pancreas might ultimately depend on an open innovation model that combines best in class insulin delivery systems, sensing technology, control algorithms and disease management tools. The shape of any eventual artificial pancreas solution may even provide some surprises. As reported by Diabetes Mine, the JDRF and Sansum Diabetes Research Institute are developing a somewhat counter-intuitive artificial pancreas concept using rapid-acting inhaled insulin. With so many interesting and promising ideas currently under investigation, these are indeed exciting times for device innovation in diabetes!